Uncontrolled jet fuel price must be checked

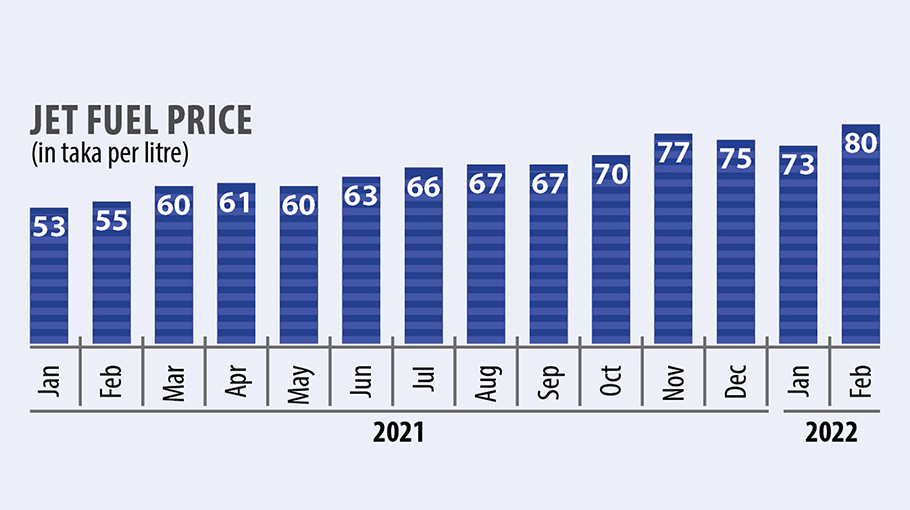

In the last three months, the price of jet fuel has increased by Tk 25 per liter and in the last 18 months, the price of jet fuel has increased by about 120 pc. In October 2020, the price of jet fuel was Tk 46 per liter, while in April 2022, the price of jet fuel per liter was Tk 100. The situation has made determining passenger fares a tough task.

To cope up with the raising jet fuel price airlines have only one choice and that is to increase fares to different destinations.

Do airlines can competitively increase the airfare based on the raising jet fuel price? Is that justified? Increasing passenger fares by competing with jet fuel has a negative impact on passenger numbers.

When the price of jet fuel rises in the international market, the price of jet fuel rises in the local market too. However, Bangladesh Petroleum Corporation often adjusts the price of jet fuel to compensate for their previous financial losses which directly affects the airline business.

The impact of the Covid-19 pandemic on the aviation and tourism business around the world over the past two years is visible. According to the news published in various media, the research of BIDS shows that the loss in the tourism sector during the pandemic is Tk 60,000 crore. About 40 percent of these losses occurred in transportation and most of which are in the aviation sector.

It is very important to keep

the aviation industry afloat by adjusting

the fuel price with necessary subsidy

In the aviation and tourism sectors, various countries have helped offset the loss of the pandemic through direct subsidies. The opposite picture is seen in Bangladesh Aviation. An excellent example is the uncontrolled increase in the price of jet fuel.

During the Covid-19 period, it was observed that the airport has set development fees and also applied for security fees. The price of jet fuel has increased 15 times in the last year and a half which has destabilized the aviation business.

During the stagnated situation of Covid-19, the authority concerned has set development fees as well as security fees at the airport. And the price of jet fuel has increased 15 times in the last one and half years, which is destabilizing the aviation business.

The current rise in jet fuel prices is having a direct impact on passenger fares which is having a negative impact on the aviation business. The cost of jet fuel is 40 pc of the operation cost of any route. There is a huge difference in income and expenditure.

The depreciation of taka against dollar in the international market has also had a negative impact on various indicators in the aviation sector which is likely to cause huge losses to Bangladeshi airlines in international competition.

Due to the economic downturn of 2008 and the rise of global jet fuel, the then newly established Best Airways and Aviana Airways was forced to cease operations in Bangladesh within days of its launch. At that time, United Airways and GMG Airlines also had to face extreme economic crisis. At the existing situation, if the price of jet fuel cannot be controlled, the aviation sector will be severely affected. If the aviation sector is damaged, the revolving tourism sector of Bangladesh will be severely disrupted.

It is important for all concerned to make a well-thought-out decision on pricing jet fuel to secure the future by properly understanding the present. In this case, it is very important to keep the aviation industry afloat by adjusting the price with the necessary subsidy. Otherwise, the market share of Bangladesh’s international routes will go to foreign airlines. As a result, the airlines investments will face difficulties. The share of GDP in the aviation sector will decrease. This will have an adverse effect on the overall economic situation of the country.

Kamrul Islam is General Manager (Marketing Support and Public Relation), US Bangla Airlines