Stimuli for large to micro entities help boost economy: MCCI

The economy has been showing signs of recovery in Q4 of FY21. The stimulus packages comfort the business groups, from large farms to petty micro-enterprises, which eventually helped the economy to boost again, said the quarterly review report of MCCI on economic situation in Bangladesh.

Metropolitan Chamber of Commerce and Industries (MCCI) released the April to June review on economic situation on Thursday.

Executive summary of the report mentions that exports and remittances are two important drivers of the economy, and amid the COVID-19 pandemic, both the areas have done well. Robust remittances and export earnings had facilitated Bangladesh's economic recovery in the just concluded fiscal year (FY21).

The report, however, reveals that the year-on-year, exports in FY21 grew by 15.10 per cent and the remittances grew by 36.11 per cent. The inward remittances have huge positive impact on rural economy to sustain the domestic consumption demand, which has multiplier effects on other economic sectors, especially the small and medium industry.

MCCI feels that the policymakers need to focus on strategies for post-COVID recovery and concentrate on policies to upgrade various private sectors so that more successful revenue-earning streams can be generated and attract reinvestments from existing investors.

Referring the Bangladesh Bank data, the said implementation process of the second phase of the stimulus package has started with the inclusion of foreign-owned companies operating in Bangladesh. Regarding export and Import, the MCCI review said that export earnings (merchandise) in FY21 increased by 15.10 per cent to US$38.76 billion from US$33.67 billion in FY20, buoyed by a revival in the shipment of readymade garment (RMG) items amid from the pandemic-induced business slowdown. Year-on-year, RMG sector rose by 12.55 per cent to US$31.46 billion in FY21, however, missed the target by 6.89 per cent. Export earnings, however, fell short of the target (US$41.00 billion) by 5.46 per cent.

Export earnings in the quarter under review (Q4 of FY21) increased significantly, year-on-year, by 108.91 per cent. While, in the last month (June 2021) of the quarter alone, export rose year-on-year by 31.75 per cent, although it was below the monthly target (US$3.67 billion) by 2.52 per cent.

Soon after the pandemic unfolded, the government on 25 March 2020 announced Tk.50.0 billion in stimulus loans for exporters.

Accordingly, the BB was set to release the funds as salaries for workers and employees of export-oriented factories through equal installments in the three months from April to June.

Import payments (C&F) in July-May of FY21, of which data is available now, stood at US$58.63 billion, which was 17.31 per cent higher than import payments during the corresponding eleven months of FY20. In the last three months i.e., March, April and May 2021, imports increased year-on-year by 44.05 per cent, 118.96 per cent and 73.68 per cent, respectively.

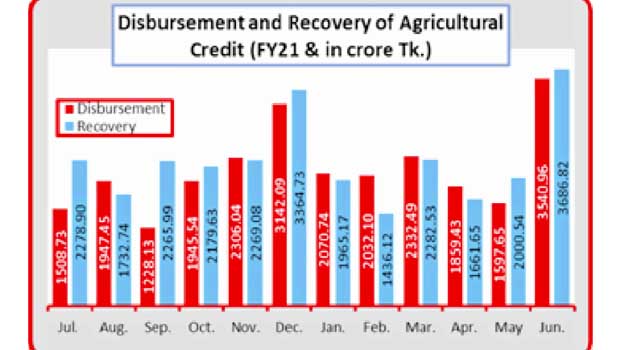

The disbursement of agricultural credit and non-farm rural credit by all scheduled banks in the just concluded fiscal year (FY21) stood at Tk.25,511 crore, an increase of 12.14 per cent from Tk.22,749 crore in the previous fiscal year, FY20 (Table 6 and Figure).

The disbursement was improved as demand for such loan is picking up gradually due to seasonal effects, also implementing stimulus packages along with providing interest subsidy, according to experts.

For the same reasons, the recovery of agricultural credit and non-farm rural credit also increased significantly by 27.67 per cent to Tk.27,124 crore in July-June of FY21, compared to Tk.21,245 crore in the corresponding period of the previous fiscal year.

The Agriculture Credit Department of the central bank has recently recommended bringing down the interest rate on farm loans based on the circumstances. Accordingly, Bangladesh Bank cut the interest rate at 8.0 per cent from the previous 9.0 per cent as part of its efforts to boost the agriculture sector amidst the ongoing economic slowdown caused by the COVID-19 pandemic.