Prime Bank, BACCO tie up for outsourcing financing

BP Business Desk

Prime Bank Limited and Bangladesh Association of Call Center and Outsourcing (BACCO) have joined hands together to facilitate financing for the entrepreneurs in the field of call center and outsourcing.

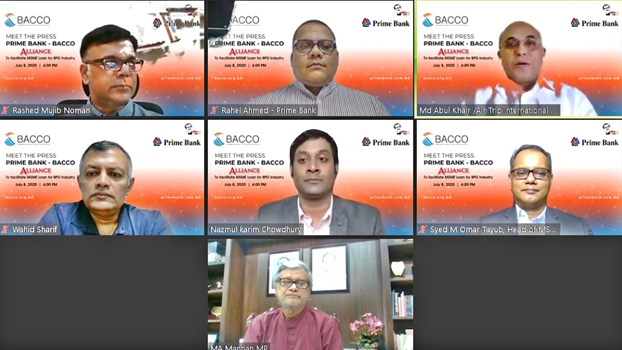

Managing Director and CEO of Prime Bank Rahel Ahmed and President of BACCO Wahidur Rahman Sharif formally launched the alliance through a virtual press meet on Wednesday. Planning minister M A Mannan MP was present as the Chief Guest.

The partnership titled “Prime Bank-BACCO Alliance for MSME Financing Solutions” will enable easy access to finance to BPO/Outsourcing companies as they strive for market expansion locally and globally.

It will be a big boost for the country’s BPO/Outsourcing sector as eligible BACCO members can now avail collateral free loan up to Tk 50 lakh and other tailor-made financing solutions. The entrepreneurs can make more contribution to the country’s economy.

Under the arrangement, the BPO/Outsourcing firms will get working capital (CC, OD and Demand Loan), Term Loans for Fixed Asset Purchase and Capital expenditures, International Trade solution- LC, LATR, IDBP etc., Bank Guarantee, Work Order etc.

They can also avail a wide range of deposit products and free Internet Banking – ALTITUDE - for conducting broad range of e-transaction. They will need two-year business experience and introduction letter from BACCO.

The companies can apply for loan from the comfort of their office or home as Prime Bank has assigned dedicated Relationship Manager for exclusive service for valued BACCO members.

Commenting on the alliance, Managing Director and CEO, Prime Bank Rahel Ahmed, said: “Prime Bank is fully aligned with the government’s vision of making a Digital Bangladesh as the country sets sight to become a middle income country.

BPO/Outsourcing sector holds huge potential as the developed countries resort to outsourcing the call center and other BPO services. We hope with the financing solution, the companies will be able to expand their services and grab more market share. Prime Bank is committed to be a part of the growth journey of this promising sector.”

Speaking on the occasion, President of BACCO Wahidur Rahman Sharif said: “BACCO has always been working to upturn the opportunities for member organizations and will continue to work for the development of the BPO industry by taking certain initiatives in the future.

We will take all possible steps to ensure that the BACCO members are able to fully avail the financial incentives announced by the Government and also hope that other banks will also come forward to assist the organizations of this promising BPO industry.”

Senior Vice President of BACCO Md. Abul Khair, BACCO Director Rashed Noman, Head of MSME Banking of Prime Bank Syed M Omar Tayub, Head of Brand and Communications Nazmul Karim Chowdhury were also present.

In view of the COVID-19 outbreak, BACCO and Prime Bank conducted the event through virtual media as part of their efforts to reinforce social distancing.