IPDC conducts first quarter investors’ meet online

BP Business Desk

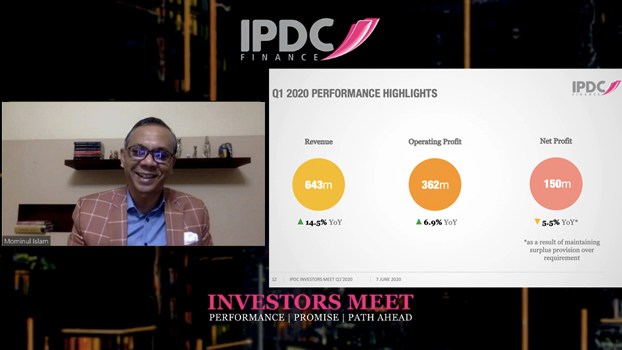

IPDC Finance Limited has conducted its Investors Meet to discuss their financial highlights, benchmarks, and key strategies for IPDC’s Q1 of 2020. The session, conducted virtually on Sunday last, also focused on the challenges that lay ahead amidst the ongoing pandemic.

The session was presented Live by the Managing Director and CEO, Mominul Islam, and the Chief Financial Officer, Fahmida Khan, of IPDC Finance. Several keen investors, industry experts, customers and business journalists attended the insightful session followed by a Q&A session. The session not only shared the Q1 financial highlights but also enlightened the spectators on its notions and the company’s standing during and post COVID-19 era.

While presenting the Q1 numbers and initiatives to the audience, Mominul Islam emphasized on fighting the ongoing battle against COVID-19 and reiterate his commitment to supporting their customers, employees and community in every extent.

Staying committed to its promise, even after maintaining surplus provision of more than 100 percent of the bottom line of Q1 2020, Profit After Tax for the quarter ending 31 March 2020 was BDT 150 million. IPDC also maintained an NPL ratio of 1.53 percent which is one of the lowest in the NBFI sector and lowest amongst the publicly listed diversified NBFIs. Customer deposit growth was 6.4 percent in the first quarter of 2020, which itself is an indicator of its diligence.

IPDC has a proven record of having sufficient liquidity to meet all short and medium-term obligations. They maintained contingency liquidity cushion amounting to 4,925 million as of 31 March 2020. The company has a strong capital base with a Capital Adequacy Ratio of 17.60 percent against the regulatory requirement of 10.00 percent.

Furthermore, the company does not have Capital Market exposure which has been going through turmoil in recent times. Despite having a strong financial position in Q1, Mominul Islam is still focused on being aware and resilient in such economic adversity.

He also shared about the company’s technology led platforms which aim to expand its footprint to financing retailers, MSMEs and consumers. Bangladesh’s only retailer financing platform, IPDC DANA, aims to on-board 2800 retailers and disburse working capital of around Tk 1,000 million to the retailers to facilitate financing in an easy, low cost, collateral-free and structured manner by the year 2020.

Similarly, Southeast Asia’s first blockchain based digital supply chain finance platform, ORJON, launched by IPDC Finance last year, also continues to support MSMEs in this difficult time by receiving 1,134 invoices and disbursing Tk 1,355 million. Moreover, IPDC EZ, a technology-led innovative solution, is facilitating the growing demand for consumer goods financing, has onboarded over 4,000 retailers as of 31 Mar 2020 and introduced digital EMI for easy payment.

IPDC Manobota Deposit Scheme, has proven to be yet another example of IPDC’s timely and innovative products during times of crisis, which allows IPDC to provide a month’s food supply to an underprivileged family against each one lakh taka deposit. Despite the ongoing economic crisis, IPDC has been relentlessly working towards helping the society combat the COVID-19 pandemic in association with various notable organisations by providing food and other necessary supplies to the distressed across the country.

While asked on company’s strength to repay customer deposits, he assured that company holds an adequate liquidity position to support any customer request and the company’s portfolio quality and solid base are testimony of its continued and current success.

Speaking at the Live session, Mominul Islam, Managing Director and CEO, IPDC Finance Limited stated, “IPDC's strategic initiatives were premeditated keeping the socio-economic challenges and potential of Bangladesh over the next ten years. Hence, despite the ongoing pandemic, we can stay committed to our goals so far.

Besides, we believe the stimulus package announced by the government will help us serve our customers with utmost security, eventually contributing to a V-shaped economic recovery in the coming days.”