Indian economy on the edge amid corona second wave

The second wave of the Covid-19 pandemic has not destabilised India’s economic recovery yet but localised lockdowns, such as the one announced in Maharashtra, may impact growth in the April-June quarter, according to Bloombergquint.

Fresh infections of the virus have been on the rise for the last few weeks, with some states hit worse than others. On Sunday, India reported 93,249 new cases — the highest since Sept. 19. Maharashtra, Karnataka and Kerala have the highest number of active cases, forcing state and city administrations to announce localised restrictions.

High-frequency data, available until March, is not showing significant signs of stress. Though the eight core industries index saw the sharpest contraction in six months in February, e-way bill collections and exports held strong. However, the April-June quarter may show weaker-than-expected sequential growth as large states like Maharashtra start to impose restrictions, particularly on high contact services, economists say.

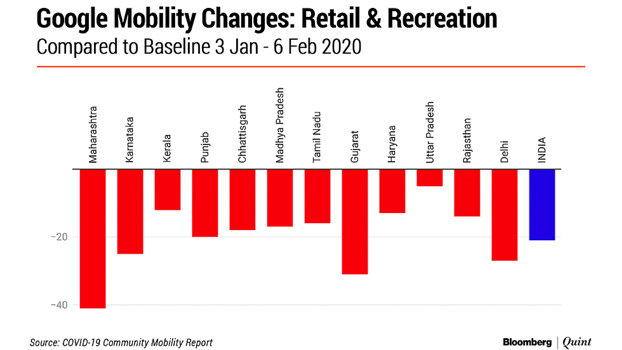

The latest Google Mobility Report shows that mobility across places of retail and recreation has dropped 30 percent between February 14- March 28 compared to the baseline. Between January 30- March 13, mobility in this segment was 22 percent below baseline. However, mobility to workplaces and within residential areas remained strong until the end of March.

States with a wider spread of new cases are showing sharper drop mobility. In Maharashtra, Karnataka, Gujarat and Delhi mobility was significantly below national aggregates across categories.

In the week ended April 4, the weekly Nomura India Business Resumption Index fell sharply to 90.4 from 94.6 a week before. This is its steepest weekly decline since mid-April last year, Nomura said. “The fall was driven by a sharp deterioration in mobility data.”

The impact across Maharashtra will worsen after the state government, on Sunday, asked a large section of private offices to move to work-from-home. Restaurants, except for delivery services, malls and other high contract services will also shut until the end of April.

Maharashtra accounts for about 14 percent of the country‘s nominal GDP. Abheek Barua, the chief economist at HDFC Bank, said that despite the selective spread of covid-19 in the second wave, the situation is concerning because of the high contribution of these states to India’s GDP.

Not just Maharashtra, but Karnataka and Delhi too are critical from an industry perspective, he said. Also, the problem with an integrated supply chain is that problems in one state can transmit to other states, Barua said.

To be sure, daily electricity data is yet to suggest any downturn in economic activity. Power demand remains robust and railway freight revenues continue to rise, suggesting no impact on the industry, Nomura said.

Even in Maharashtra, where the strictest lockdown has been imposed, manufacturing facilities are being allowed to function.

“Consumer and businesses have adapted to the new normal, lockdowns are likely to be localised, the goods sector should continue to recover and vaccinations are gathering momentum,” Nomura economists Sonal Varma and Aurodeep Nandi said. “The lagged impact of easy financial conditions, fiscal activism and strong global growth remain cyclical tailwinds.”

The sectors of the economy that seem most at risk from a second wave are hotels, restaurants and transportation, Varma and Nandi added.

In the services sector, business is already starting to see a slowdown. Sectors most at risk from a second wave — hospitality and transportation services — account for about 5.7 percent of GDP.

While footfalls at the start of the year were close to 60-70 percent of pre-covid levels, they have fallen by 40 percent since then, said Kumar Rajagopalan, CEO of the Retailers Association of India, pointing to the restrictions placed in Mumbai.

Even before the new restrictions were announced, Mumbai’s municipal corporation was conducting randomised Covid tests at crowded locations. The move deterred visitors, bringing retailers back to square one, Rajagopalan said.

“In other states, the impact is not as much yet but the association remains in a wait-and-watch mode,” Rajagopalan said.

Across the restaurant sector, the impact is similar.

Pranav Rungta, head of the Mumbai chapter at the National Restaurant Association, said business has reduced to 15-20 percent of pre-covid times compared to 75-80 percent in January and February. This is likely fall further as in-person dining is restricted starting this week.

Rungta added that the uncertainty and volatility will also make consumers conservative about spending once again.

While much of the impact is still limited to Mumbai and Maharashtra, footfalls in Bengaluru and Delhi are likely to have dropped by 10-15 percent compared to what they were in the early part of the year, Rungta said.